.png)

This article is a culmination of our in-depth analysis and hands-on experiences testing, trading, and farming yield within the Optimism ecosystem. It aims to shed light on the nuances, strengths, and potential pitfalls of various yield opportunities.

From hidden gems to widely-recognized pools, this journey has revealed a spectrum of opportunities and challenges that are quintessential for anyone looking to navigate the Optimism DeFi landscape.

Optimism is a Layer 2 (L2) Blockchain built on Ethereum. Here’s an in-depth explanation of how Optimism works, but essentially it’s used to enhance Ethereum’s scalability and efficiency, allowing for faster and cheaper transactions. As one of the more active L2s with a robust and thriving DeFi ecosystem, Optimism currently offers plenty of attractive yield opportunities.

Uniswap v3 (Optimism) dominates the Optimism playing field in terms of trading volume market share, which is unsurprising because of Uniswap’s DeFi dominance in general. Other notable multichain DEXes that work on Optimism include KyberSwap Elastic and Curve, and then there’s the Optimism-native DEXes Velodrome and Beethoven X. That’s not all, but we’ll get to the more advanced yield farming strategies later on.

We’ll focus primarily on the Optimism network yield opportunities on Uniswap v3 in order to familiarize ourselves with the popular pairs, and then we’ll look at some higher risk/reward opportunities on other protocols.

As mentioned above, Uniswap is the dominant protocol on Optimism with significantly higher trading volume than competitors and over $80m TVL. This makes it an ideal place to start.

Uniswap v3 (Optimism) is growing rapidly, with its TVL pushing back toward its Feb 7, 2023 all-time-high of $95.59m, and a spike to nearly $100m 24h trading volume as recently as Nov 10, 2023.

Yield farming on Uniswap v3 (Optimism) is as simple as it gets. Just connect your wallet, switch to the Optimism network, and add your assets to a pool of your choosing. In return you earn a portion of the trading fees generated by that pool, and sometimes you can take advantage of platform-specific token incentive programs, which we’ll discuss below.

Uniswap offers different fee tiers for its liquidity pools, such as 0.05%, 0.30%, and 1.00%. These fee tiers are designed to accommodate the varying levels of risk and trading volume associated with different types of assets. The impact of these fee structures on liquidity pools and liquidity providers (LPs) can be significant:

0.05% Fee Tier: This lowest fee tier is typically for pools with very stable pairs, such as those between stablecoins (e.g., USDC/DAI). These pairs have low price volatility, meaning the risk of impermanent loss is lower for LPs. The lower fee reflects the lower risk and often lower trading volume. LPs earn less per transaction, but the lower risk makes it suitable for more risk-averse investors.

0.30% Fee Tier: This is the standard fee tier, often applied to a wide range of pools, including those with a mix of stablecoins and more volatile assets or between two moderately volatile assets. This fee structure strikes a balance between risk and reward for LPs. While there’s a higher risk of impermanent loss compared to the 0.05% tier, LPs potentially earn more from fees due to the higher rate.

1.00% Fee Tier: This highest fee tier is for pools that include highly volatile assets or pairs with lower liquidity. The high fee compensates LPs for the increased risk of impermanent loss and potentially lower trading volumes. Pools in this tier might see fewer but larger trades, and the higher fee rate is meant to attract liquidity to these riskier pairs.

The choice of fee tier affects LPs in terms of the potential income from fees and the risk they take on:

Income Potential: Higher fees can mean higher income per transaction, which is appealing, especially in pools with reasonable trading volumes.

Risk of Impermanent Loss: Pools with more volatile assets (and thus higher fees) carry a higher risk of impermanent loss, where the value of the deposited assets changes unfavorably compared to holding them outside the pool.

Pool Selection: LPs must consider the fee tier when choosing which pool to invest in, balancing their risk tolerance with their income goals.

Overall, the fee structure is a crucial part of Uniswap’s design, influencing both the liquidity of different pools and the attractiveness of providing liquidity from an LPs perspective.

Pool 1: WETH-OP 0.3% | $10.60m TVL | $6.10m 24h Volume | ~63.01% APR

It makes sense for WETH-OP to be the top pool by TVL on Uniswap v3 (Optimism) because OP is the native token of the network. Its central role in the network’s operations and governance naturally attracts significant trading interest, which in turn generates yield, which incentivizes LPs to invest in the pool.

Yield Potential:

Liquidity and Depth:

Overall Assessment:

The WETH-OP 0.3% pool on Uniswap is a high-performing liquidity pool with substantial yield potential, backed by significant liquidity and trading volume. The pool’s success is likely driven by the combination of a popular and stable asset (WETH) with a growing Layer 2 token (OP).

Pool 2: WETH-PIKA 0.05% | $7.05m TVL | $3.86m 24h Volume | ~9.99% APR

The WETH-PIKA 0.05% pool was launched on Uniswap v3 (Optimism) less than 24h ago at the time of writing, so it’s a good learning opportunity for beginners who are wondering how to assess new pools with limited data.

PIKA is the native token for Pika Protocol, which is a decentralized perpetuals swap exchange on Optimism offering high-leverage trading; before making any decisions about this pool you’ll want to review the official Pika Procol documents to inform yourself about the PIKA asset.

It’s worth noting that the value of PIKA rose from ~$0.14 on Nov 10 to ~$0.33 on Nov 12, indicating significant trading activity around the launch of the new pool. This indicates a potential for strong volatility in the short-term.

Yield Potential:

Liquidity and Depth:

Overall Assessment:

The WETH-PIKA 0.05% pool presents a promising yield opportunity, balanced by the volatility and market dynamics associated with a newly launched pool. Investors should consider the possibility of fluctuating volumes and prices in their strategies.

Pool 3: WETH-USDC 0.05% | $6m TVL | $9.85m 24h Volume | ~29.96% APR

Being the lowest fee pool for WETH-USDC on the most dominant protocol (Uniswap), this is by far the most popular trading pair for users looking to swap WETH for USDC or vise versa on the Optimism network, which contributes to its relatively high trading volume.

Yield Potential:

Liquidity and Depth:

Overall Assessment:

The WETH-USDC 0.05% pool presents an attractive opportunity for liquidity providers, combining the stability of USDC with the liquidity of WETH, backed by a high APR. It’s well-suited for those seeking a balance between return and stability.

Pool 4: WETH-WBTC 0.3% | $2.93m TVL | $0.1m 24h Volume | ~3.74% APR

While having a significantly lower trading volume and APR than other pairs on the list, the TVL for the WETH-WBTC 0.3% pair is still higher than other pairs simply because of the nature of the two assets involved and the relatively high liquidity associated with them.

Yield Potential:

Liquidity and Depth:

Overall Assessment:

The WETH-WBTC 0.3% pool might appeal to traders and liquidity providers interested in high-value crypto assets. The lower APR suggests it’s currently less active, which could change with market movements.

Pool 5: WETH-USDC 0.3% | $2.91m TVL | $0.71m 24h Volume | ~26.72% APR

The only difference between this pool and Pool 3 is the fee structure. While this pair has lower TVL and significantly lower trading volume, the higher fee of 0.3% compared to 0.05% contributes to the relatively similar APR.

Yield Potential:

Liquidity and Depth:

Overall Assessment:

The WETH-USDC 0.3% pool offers a good balance between the liquidity of WETH and the stability of USDC, underpinned by a high APR. It’s suitable for those looking for robust returns with a moderate risk profile.

Note: The APR calculation used for the pools above is based solely on the current TVL, trading volume, and fee structure for each pool, so it’s approximate. Additional factors, such as pool-specific liquidity mining incentives and asset volatility between each pair, as well as fluctuations in TVL and trading volumes, could impact the APR for a given pool. Further, Uniswap v3’s particular calculation for APR considers other factors related to concentrated liquidity, dynamic liquidity, and custom price ranges. Learn more about these advanced concepts here.

Velodrome is the top DEX native to the Optimism network in terms of trading volume and TVL. As far as users and LPs are concerned, it operates very similarly to Uniswap, but with a few distinctions that we’ll outline below. Note that the user experience on Velodrome might be less intuitive for users who are primarily familiar with Uniswap’s interface, and therefore it’s recommended for more experienced investors.

Using Velodrome is not much different than using Uniswap. You connect your wallet, choose your pool, and add your assets to the pool. You can also quite easily create pools and add incentives, but that’s a bit more advanced than what we’re trying to cover in this article.

Here are the top 5 Volatile Pools on Velodrome in terms of expected APR:

The first thing to notice about these 5 pools is that we’re now working with significantly lower trading volume and liquidity than the 5 Uniswap pools from above. None of the pools have realized more than $100k trading volume in the past 24h, and none have generated more than $1,000 in fees. Choosing to farm any of these pools should be done with caution. Let’s take a closer look at and compare the top 2.

The PEPE-VELO 1.0% pool has under $2,000 TVL, and has generated just $2.78 in fees. The high APR is simply the result of some added incentives to the pool, but you wouldn’t be able to buy more than $100 worth without significantly impacting the price, due to the low liquidity. There is also the high-risk volatility associated with the nature of the PEPE asset, being a meme coin. This pool isn’t as attractive as it looks at first glance.

The GNode-USDC 1.0% pool is at 390% APR, with significantly higher trading volume at nearly $80k compared to just $275 in the PEPE pool. The stable pairing adds a significant stability factor, while the GNode asset is expected to be more volatile. This pool offers high returns for investors with a high risk appetite.

Here are the 5 Volatile Pools on Velodrome that generated the most fees in the past 24h:

These pools all have much higher volume and liquidity, leading to much greater generation of fees, which means more yield opportunity, and they still have some quite attractive APR thanks to platform incentives. At 81.5% APR, the USDC-VELO 1.0% pool is surely the best available pool in terms of risk/reward given the stable nature of USDC and the native token influence of VELO (it’s the native token of Velodrome).

The OP-USDC 0.3% pool offers lower APR, but with this pair you are only exposed to the stable USDC and the native Optimism token OP.

The OP-Velo 1.0% pool is like a combination of the above pools without the stability of USDC. With lower APR than the USDC-VELO pair at 53.39%, it’s slightly less attractive for most strategies because it has more inherent risk without more reward. This pool is for investors who specifically want exposure to both assets in the pool.

Note: there are some solid pools in the Stable Pools category on Velodrome too, some with up to 30%+ APR such as the USDC-MAI 0.3% pool. It’s worth looking into these as well.

Here are the top 5 Stable Pools in terms of trading volume:

And one final pool I’d like to highlight on Velodrome if just for its simplicity is the WETH-USDC trading pair. 11% APR seems low, but it’s pretty good for a 0.3% fee pool that has relatively high liquidity, plus the exposure is only to the blue chip ETH and the stable USDC.

KyberSwap Elastic is a multichain DEX that offers unique features compared to platforms like Uniswap v3 and Velodrome Finance, such as:

Here are the top 6 KyberSwap Elastic pools in terms of APR:

The above pools strike a perfect balance between Uniswap v3’s relatively lower APR but lower risk, and Velodrome’s slightly higher APR for its riskier pairs. The APR on KyberSwap Elastic is very high considering the nature of most of these pairs, namely the blue chip assets like ETH and LINK (and relatively speaking OP), paired with stablecoins at 240%+ APR.

Of course, there’s always a catch. The high APR on the pairs above is mostly from KyberSwap Elastic’s platform-specific incentives, not trading fees.

KyberSwap Elastic Farming operates through a process called Liquidity Mining, where Liquidity Providers (LPs) earn rewards for contributing to liquidity pools. The process includes:

If you look at the pools above again, you’ll see a countdown in the bottom right which says “17D 7H 56M”, which is how long the current incentive structure will be active for. As we saw with Velodrome, and with Uniswap in the past, these incentive periods can offer significant yield opportunities with lower risk than you might expect, if you catch them at the right times.

Beethoven X is a DEX based on the Fantom and Optimism networks. It’s essentially a “friendly fork” of Balancer V2, a protocol on the Ethereum network, with improvements in user experience and accessibility. Beethoven X is known for its themed, music-inspired approach, featuring liquidity pools with names like “The Grand Orchestra” and “Fantom of the Opera”, and a token named “Beets”. It’s fun and quirky, but it also has in our humble opinion a positively fantastic UI — the best of all protocols mentioned so far.

In comparison to other DEXs like Velodrome, Uniswap, and KyberSwap, Beethoven X’s unique approach lies in its weighted investment pool system, its ability to handle up to eight different assets in a single pool, and its specialized Stable Pools for trading stable assets with low slippage (similar to Velodrome).

Here are the top 5 Optimism-based pools in terms of APR on Beethoven X:

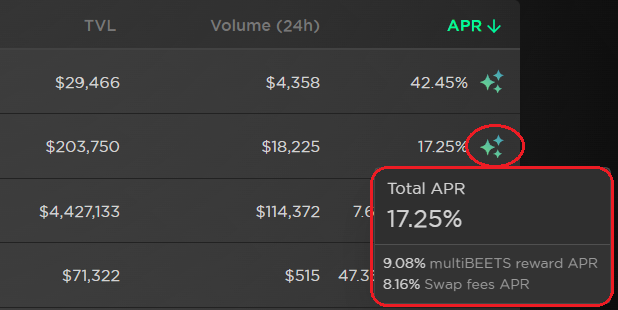

While again we’re seeing relatively low trading volume on some pairs, there are platform-specific incentives to bolster the APR. The Happy Road pool is comprised of 40% WETH, 40% OP, and 20% USDC for example, and more than 50% of the APR comes in the platform native token multiBEETs.

One of the best features on Beethoven X is the ability to hover your mouse near the APR and find out the exact emissions.

Many of the Beethoven X pools are comprised of more speculative and high-risk assets than have typically been mentioned so far in this article, so extreme caution is recommended when exploring this protocol.

While there are some attractive yield farming opportunities on Beethoven X, and the multi-asset pools offer a unique and refreshing approach, this platform and its strategies are recommended only for advanced LPs who have a firm grasp of the DeFi landscape already.

Curve is a no nonsense kind of platform for no nonsense kinds of people.

Curve Finance is a DEX that specializes in trading stablecoins and assets with similar values, using automated market-making protocols. It’s known particularly for its low slippage, which it achieves by allowing multiple assets in a pool and eliminating the need for an intermediary token for stablecoin trades.

Unlike Uniswap, where liquidity pools always consist of a token pairing, Curve Finance pools can contain multiple assets, or a pool itself may be used as an asset inside another pool. For example, the 3pool on Curve Finance includes three popular dollar-pegged stablecoins: DAI, USDC, and USDT. Curve also supports trading of mirrored assets, like wBTC and renBTC, and the reserve balances in its pools do not necessarily need to be equally balanced. Curve Finance’s pools can even include DeFi tokens, such as Compound’s cTokens or Yearn Finance’s yTokens, which are tokens representing stakes in other DeFi protocols.

As we said, no nonsense kind of stuff. Not for beginners.

Here are all 7 Curve Finance pools on Optimism:

With Curve Finance being operational since 2020 without any major hiccups, and high general trust from the majority of the DeFi community, this protocol has its appeal mostly for high-volume traders or institutional investors looking for maximum reliability. Its UI is noticeably dated and its strategies are remarkably complex. The Optimism-based pools don’t offer high enough APR for this protocol to be worth exploring for beginners.

So far we’ve covered the essentials. Uniswap v3, KyberSwap Elastic, Velodrome Finance, Beethoven X, and Curve Finance. Before getting into the more advanced strategies below, which can maximize yield but might involve higher risk, one should be familiar with all of the strategies above.

Arrakis Finance is a liquidity management protocol designed to address several challenges in DeFi and to enhance the efficiency of liquidity provision across multiple blockchains. It’s particularly notable for its use in bootstrapping liquidity for tokens and is utilized by leading DeFi projects such as Aave, MakerDAO, and Synthetix.

Broadly speaking, Arrakis offers 3 different types of vaults for liquidity management:

They also offer pools with Liquid Staking Tokens (LSTs). LSTs allow you to leverage your assets; here’s an example:

1. Stake ETH on a platform such as Lido to receive stETH (you will earn rewards on your staked ETH).

2. Convert your stETH to wstETH (wrapped stETH), which also can be done on Lido.

3. Stake your wstETH again on a platform like Arrakis to earn more yield.

This way you earn yield on the initial staking of your ETH, and then again when you stake the wstETH.

Here’s an example of an Optimism-based LST Vault on Arrakis:

Toros Finance is a DeFi platform that integrates dHEDGE, Aave, and 1inch to offer a suite of on-chain tokenized derivatives products. It stands out by providing automated Vaults with various strategies to maximize returns. These Vaults, known as Dynamic Vaults, use algorithmic investment strategies targeting specific payoffs. The strategies can change for improved returns while maintaining constant underlying market risk. For example, the Toros Stablecoin Yield vault targets USD yields but can update its underlying assets and strategy to enhance yields.

Another example is the ETHy (Ethereum Yield) vault from Toros. It also operates through dynamic strategies to generate yield. Here’s how it works:

All you need for this strategy is some ETH in your wallet and an appetite for moderate risk. Throw in your ETH and the ETHy vault will adapt to market conditions to try to get you the best returns.

While 26% APR might seem low for this advanced section, keep in mind that this is just an alternative to staking ETH which would normally generate around 4–7% APR on a platform like Lido, but the Toros protocol managing your ETH allows you to generate far more exceptional yield on this blue chip asset. It’s less yield than if you go the route of staking ETH to get wstETH to stake again, but it’s also far less work.

While we’ve already covered some high APR Optimism-based pools on Velodrome, we neglected to mention that they do have more advanced pools involving wstETH and other LST assets as well. For example, the Velo v2 wstETH-WETH pool is used by the Toros ETHy vault above to help generate more yield. If you want to be more involved in your asset management, you can just use this vault yourself which offers high yield, especially considering you get the yield from the staked ETH on top of the Velodrome pool yield.

Over the past year, I’ve farmed 100s of pools in the Optimism ecosystem and I’ve learned a lot.

By far the easiest place for beginners to start earning solid yield is on Uniswap v3, particularly on its USDC and OP pairs. This protocol is the ideal place to start your Optimism yield farming journey.

Velodrome offers more exotic yield opportunities with higher APR, but inherently higher risk. We would only recommend farming on Velodrome to investors with intermediate DeFi experience levels at least.

KyberSwap Elastic strikes perhaps the best balance between the two above, but the relatively high APR on lower-risk pairs is primarily the result of the current incentive period for those pools. KyberSwap Elastic is a great protocol for beginners, but the high APR shouldn’t be expected to be maintained indefinitely.

Curve Finance and Beethoven X with their multi-asset pools are both great protocols, although the user experience between them is significantly different. Curve offers advanced and unique strategies for advanced investors, while Beethoven X makes similar strategies more intuitive and accessible to intermediate users.

Platforms like Toros Finance and Arrakis Finance are capable of providing advanced strategies with attractive yields for the most savvy investors who want to squeeze every last drop from their liquidity. While they don’t require additional technical skills to use compared with the other platforms in this article, they do have more complex ways of putting your money to use, and it’s best to understand how they work before jumping right in.

If all this seems like too much work — if “being your own bank” isn’t as appealing as it sounds after reading this article — don’t worry! We have the perfect solution.

Providing liquidity to farm yield from trading fees is only one aspect of yield farming in DeFi. There are several other methods for earning yield, each with its unique approach and risk profile:

Each of these methods comes with its own set of risks and complexities. For instance, lending bears the risk of borrower default, while staking in governance may lock up funds for a certain period. They are all viable strategies though.

--

Instead of manually reviewing dozens of web pages searching for the best yields, you can also use DeFi analytics & aggregator tools such as One Click Crypto. One Click Crypto is the front page of DeFi yield where you can explore 20,000+ yield farming opportunities from 14+ networks, all in one place. It also has an embedded AI portfolio builder that can help craft a personalized strategy tailored individually for you.

Here’s an example of a portfolio on the Optimism chain generated by One Click Crypto:

Disclaimer: This article, including insights on the “Rainforest Stack” and other DeFi strategies, is for informational purposes only and should not be considered as financial advice, investment recommendations, or an endorsement of any particular investment or strategy. The cryptocurrency and DeFi markets are highly volatile and unpredictable. Past performance is not indicative of future results. One Click Crypto makes no representations or warranties regarding the accuracy, completeness, or timeliness of the information provided. Readers should conduct their own research and consult with independent financial advisors before making any investment decisions. By using this information, you agree that One Click Crypto is not liable for any losses or damages arising from your investment choices.

We regularly prepare insightful reports and case studies about crypto trading and the blockchain industry.

.png)

Congrats! You successfully joined One Click Crypto waiting list. Keep an eye on your inbox, you will get updates soon.

In the meantime, join our communities to be extra cool